Coeur d’Alene, Idaho – January 31, 2017 – Timberline Resources Corporation (OTCQB: TLRS; TSX-V: TBR) (“Timberline” or the “Company”) announced today positive preliminary results from on-going metallurgical testing being performed on mineralized material at its Talapoosa gold project in Lyon County, Nevada. The testing is designed to confirm the predicted gold and silver recoveries and assess leaching efficiency in the processing of the mineralized material as identified in the Company’s Preliminary Economic Assessment (“PEA”) issued in May 2015. In addition, the testing supports the work of previous operators and will guide planning for additional testing planned in advance of engineering design.

The positive Talapoosa PEA that was completed and released on April 27, 2015 by WSP Canada envisioned the project as an open-pit, gold-silver, heap-leach operation (“Preliminary Economic Assessment on the Talapoosa Project, Nevada, effective April 27, 2015). PEA results included:

- Estimated average annual production of 55,000 oz of gold and 679,000 oz of silver for 11 years

- LOM all-in sustaining costs of $599/oz gold (net of silver by-product at $16/oz silver price)

- After-tax NPV5% of $136 million and 39% IRR at $1,150/oz gold price and $16/oz silver price

- Low initial capital requirement of $51 million.

Timberline’s President and CEO Steven Osterberg commented, “The metallurgical testing was designed to confirm, and potentially enhance, gold and silver recoveries estimated in the PEA, which result in very attractive project economics. The testing also provides data to support processes that de-risk the operating plan and confirm the potential to increase recoveries by alternate processing methods.”

Permeability Testing

Metallurgical testing is on-going on four drill core composite samples duplicating those collected and tested in 2012 by Gunpoint Exploration (“Gunpoint”) from the Bear Creek Hanging Wall (“BCHW”) and Bear Creek Footwall (“BCFW”) zones. The BCHW and BCFW zones of mineralized material represent the majority of the Talapoosa gold and silver deposit. Each composite sample was crushed by high pressure grinding roll (“HPGR”) to -1.7mm (-10 mesh), and separated by screening into a fine fraction (-75µm or -200 mesh) and a coarse fraction (+75µm or +200 mesh).

Saturated permeability was measured in laboratory testing on each coarse fraction under load pressures simulating 200 feet of leach pad height. Compared to the rate of leachate solution to be applied on the heap leach pad as proposed in the PEA, these permeability test results indicate that, on average, the heap leach pad would maintain acceptable levels of permeability at more than 20 times the anticipated application rate of the leachate solution. Based on these results we have concluded that permeability of the heap leach pad for the coarse material is very good.

Column Leach Testing

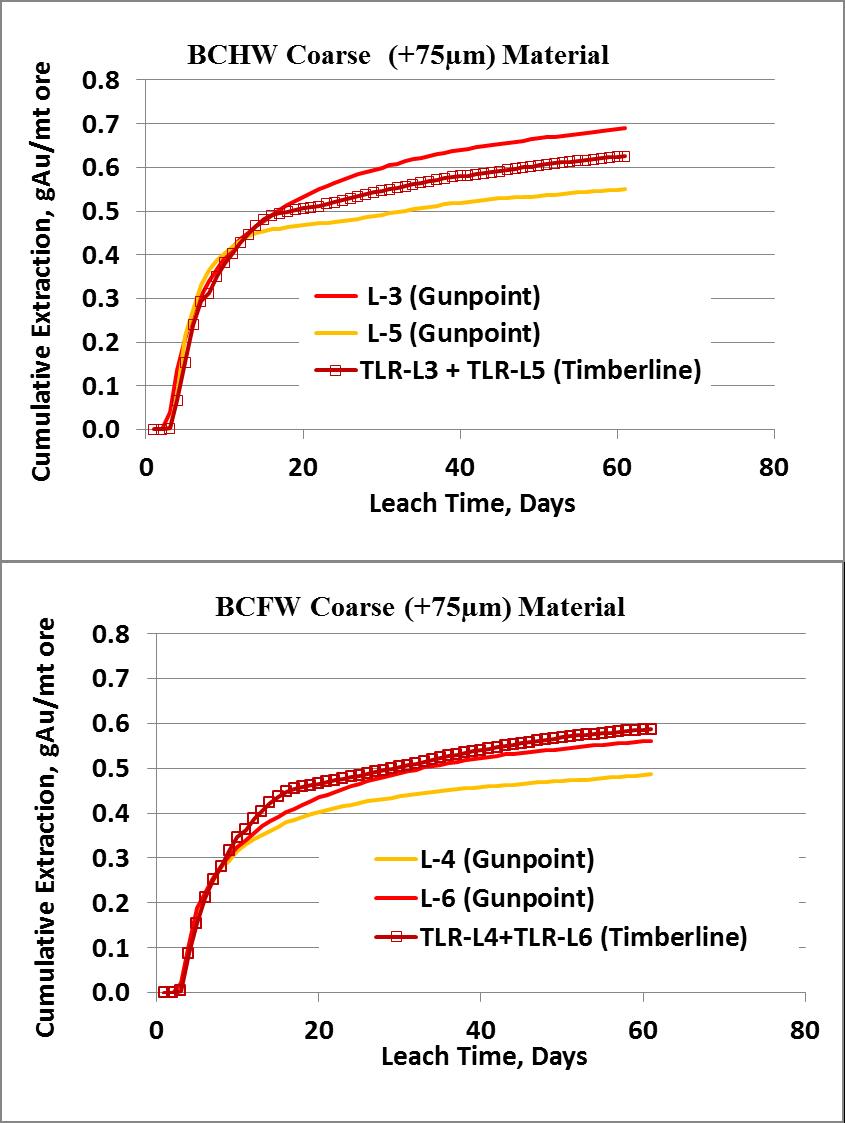

Two column leach tests of agglomerated coarse material are on-going. To-date, cumulative gold and silver extracted in the leachate solution indicates that recovery trends closely parallel those generated in previous column tests by Gunpoint upon which recoveries were predicted in the PEA (Figure 1). Based on positive recovery slopes and the previous leach trends, it is anticipated that gold recoveries will match or exceed the PEA estimates of 65% for the BCHW zone and 59% for the BCFW zone. The column tests will continue until recovery curves flatten. Silver recoveries also parallel previous trends.

Figure 1. Interim Gold Leach Rate Profiles, Column Leach Tests of Agglomerated BCFW and BCHW Coarse (+75µm) Material

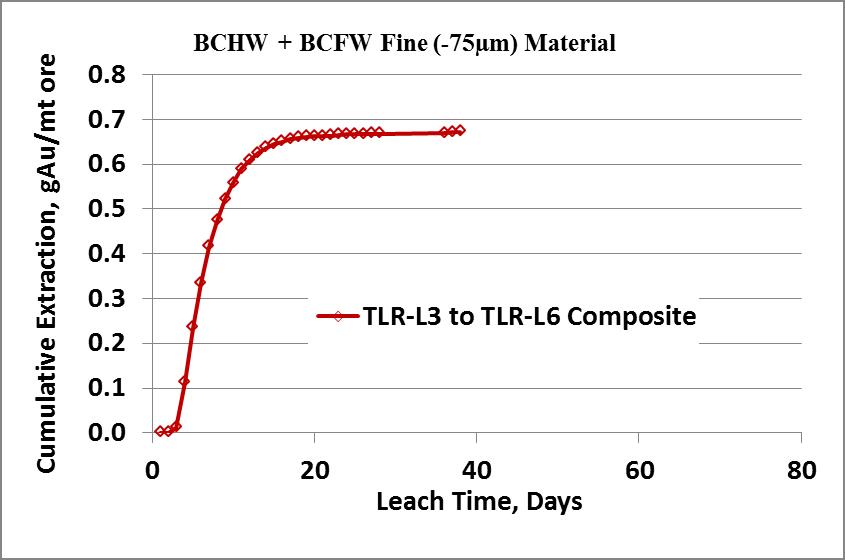

A separate column test of agglomerated fine material is currently leaching and demonstrates accelerated leaching of gold through the initial 10 days (Figure 2). The recovery of gold is estimated to be approximately 80% for gold and 55% for silver, based on extracted solution and head grades.

Figure 2. Interim Gold Leach Rate Profiles, Column Leach Tests of Agglomerated Composite of BCFW and BCHW Fine (-75µm) Material

Bucket Leach Testing

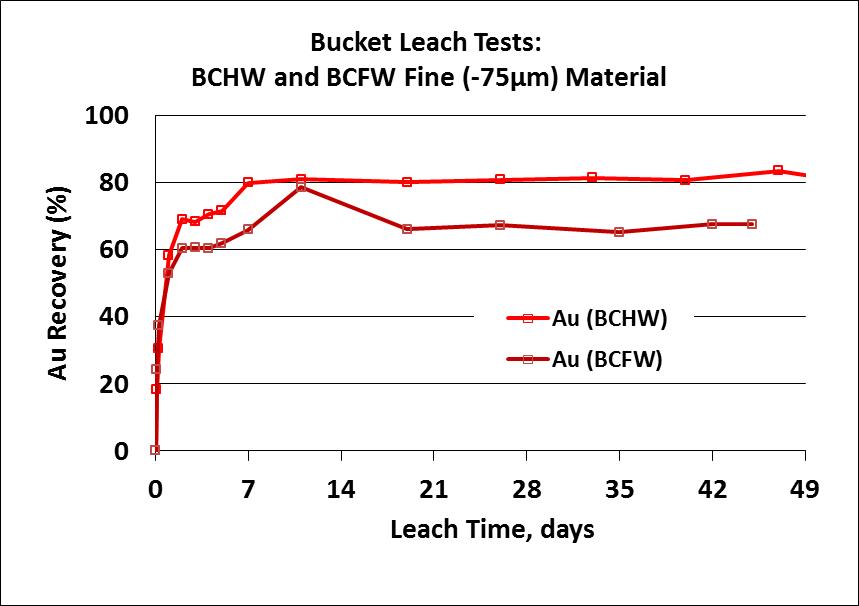

In addition to the on-going column tests on the coarse and fine material, bucket leach tests have been completed on the fine fraction of the combined BCHW and BCFW material to test potential vat leaching of gold and silver.

Final gold and silver leach results after 7 weeks of testing indicate recovery of approximately 82% of the gold and 60% of the silver in the BCHW fine material and approximately 68% of the gold and 66% of the silver in the BCFW fine material (Figure 3). Most of the recovery occurs within the initial 48 hours of leaching.

Figure 3. Interim Gold Leach Rate Profiles, Bucket Leach Tests of Agglomerated BCFW and BCHW Fine (-75µm) Material

Commenting on the results to-date, Timberline’s President and CEO Steven Osterberg added, “The permeability and leach test results are encouraging and demonstrate that effective leaching of finely crushed material will enhance gold and silver recoveries. With the proven and cost-effective capability of HPGR crushing, and available particle separation technologies, we expect that the separate leaching of agglomerated fine and coarse fractions will result in combined gold and silver recovery levels at or above those estimated in the Talapoosa PEA. The potential has also been established to increase gold and silver recoveries through vat leaching of finely crushed material. We look forward to advancing this testing following additional drilling planned for collection of metallurgical samples.”

PEA Disclaimer

The PEA is preliminary in nature and the economic analysis it presents is based, in part, on Inferred Resources that are considered too speculative geologically to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. There is no certainty that the economic forecasts contained within the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

About Timberline Resources

Timberline Resources Corporation is focused on advancing district-scale gold exploration and development projects in Nevada, including its Talapoosa project in Lyon County where the Company has completed and disclosed a positive preliminary economic assessment. Timberline also controls the 23 square-mile Eureka project lying on the Battle Mountain-Eureka gold trend. At Eureka, the Company continues to advance its Lookout Mountain and Windfall project areas. Exploration potential occurs within three separate structural-stratigraphic trends defined by distinct geochemical gold anomalies. Timberline also owns the Seven Troughs property in northern Nevada, known to be one of the state’s highest grade former producers.

Timberline is listed on the OTCQB where it trades under the symbol “TLRS” and on the TSX Venture Exchange where it trades under the symbol “TBR”.

Steven Osterberg, Ph.D., P.G., Timberline’s President and Chief Executive Officer, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release.

Forward-looking Statements

Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These statements include but are not limited to statements regarding the current and future design of the metallurgical testing; the predicted gold and silver recoveries and leaching efficiency estimated in the PEA; planning for additional testing; any future engineering designs, if any; PEA estimates and results, including estimated annual production rates for gold and silver, metals prices, all-in-sustaining costs, NPV and IRR of the Talapoosa project, and project capital expenditures; attractiveness of project economics; de-risk of the operating plan; the potential to increase recoveries by alternate processing methods; zones of mineralized material representing the majority of the Talapoosa gold and silver deposit; the heap leach pad maintaining acceptable levels of permeability at more than 20 times the anticipated application rate of the leachate solution; the permeability of the heap leach pad for the coarse material being very good; gold recoveries matching or exceeding the PEA estimates for the various zones; gold recoveries from the agglomerated fine fraction of mineralized material; potential results of vat leaching of gold and silver from the fine fraction of mineralized material; the separate leaching of agglomerated fine and coarse fractions resulting in combined gold and silver recovery levels at or above those estimated in the Talapoosa PEA; the potential to increase gold and silver recoveries through vat leaching of finely crushed material; advancing this testing following additional future drilling; the potential to establish mineral reserves; advancement of projects; and exploration potential. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target”, “intend” and “expect” and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, risks related to changes in the Company’s business resulting in changes in the use of proceeds, and other such factors, including risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended September 30, 2016. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information Please Contact:

Steven A. Osterberg

President and CEO

Tel: 208-664-4859

E-mail: [email protected]