Coeur d’Alene, Idaho – October 2, 2018 – Timberline Resources Corporation (OTCQB: TLRS; TSX-V: TBR) (“Timberline” or the “Company”) announces that a detailed gravity survey and analysis of historic geophysical survey data have identified untested targets for high-grade, “Carlin-style” gold mineralization at the Lookout Mountain Project within its 23-square mile (60 km2) Eureka property in Nevada. The gravity, CSAMT, induced polarization (IP), and magnetic data show distinct geophysical signatures over previously identified high-grade gold mineralization on the property. These geophysical signatures were then used to identify possible extensions of the mineralized zones and new targets for drilling.

Timberline’s President and CEO, Steven Osterberg, noted: “The gravity and other historical geophysical surveys have identified high-priority drill targets, including immediately east and southeast of the historic Lookout Mountain pit. We intend to drill these targets.”

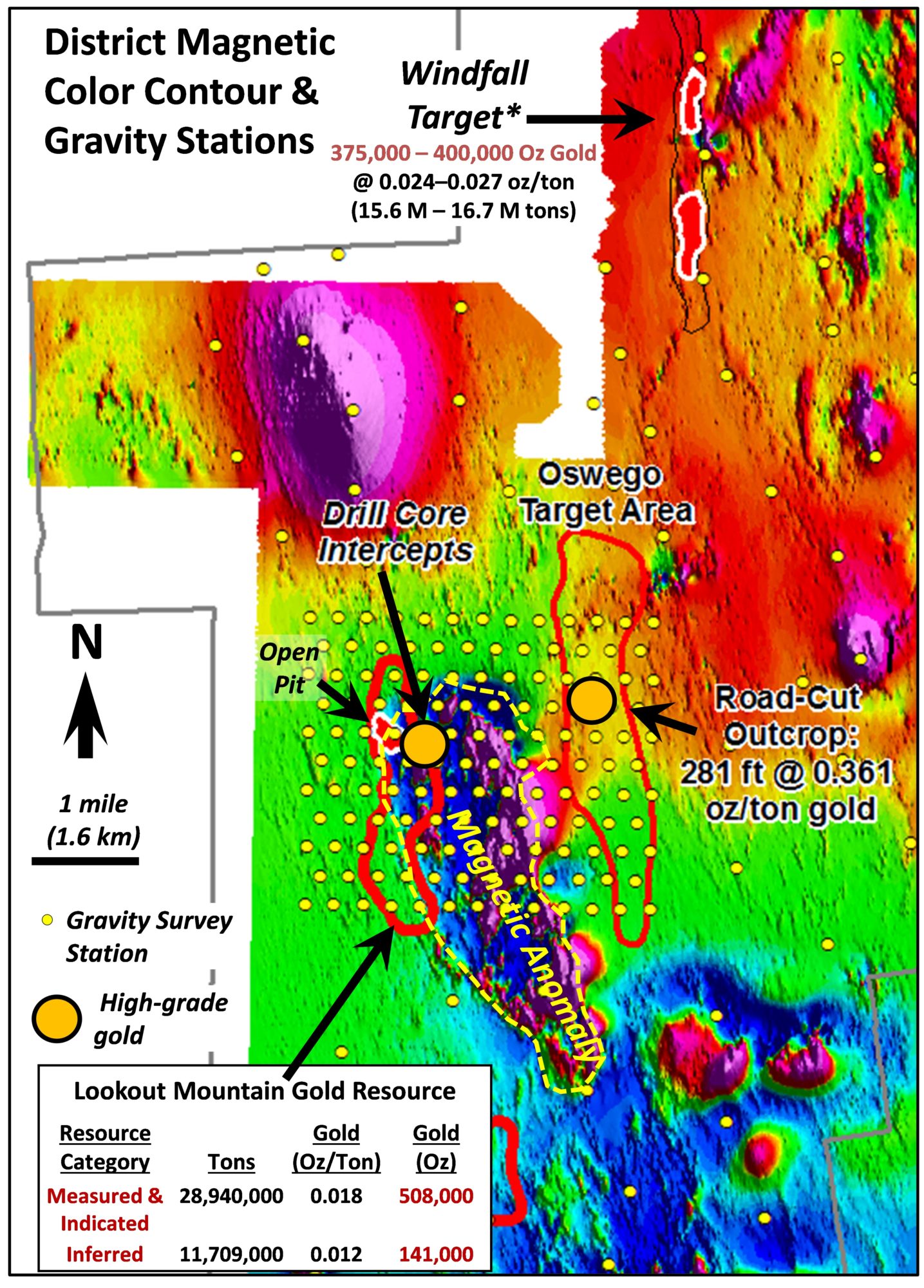

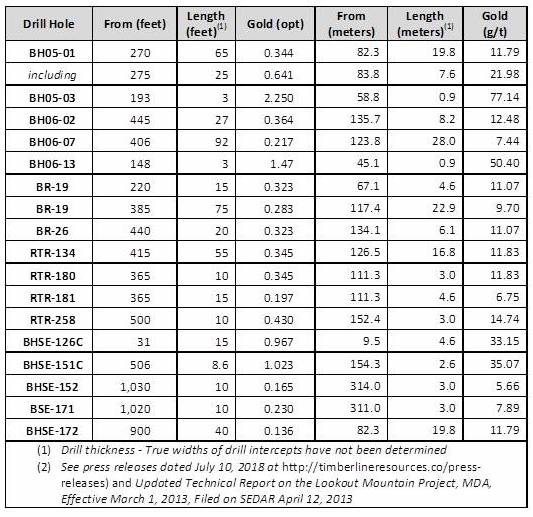

Lookout Mountain represents a large “Carlin-style” gold-system with a defined gold resource (see Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, Filed on SEDAR April 12, 2013) and drill-indicated mineralization (Figure 1) extending over a north-south trend of approximately 3 miles (~ 5 km). High-grade gold mineralization near the historic open pit occurs on a northwest-southeast trend and includes 17 intercepts of between 0.136 opt & up to 2.250 opt gold (Table 1)(see press releases dated June 12, 2018 and July 10, 2018 at https://timberlineresources.co/press-releases). The mineralization is associated with extensive zones of structurally controlled fault- and gouge-breccias, as well as carbonaceous collapse-breccias, and with orpiment and realgar (arsenic sulfides) (Figure 2) which are commonly found in many major Carlin-style gold deposits.

Eureka Gravity Survey

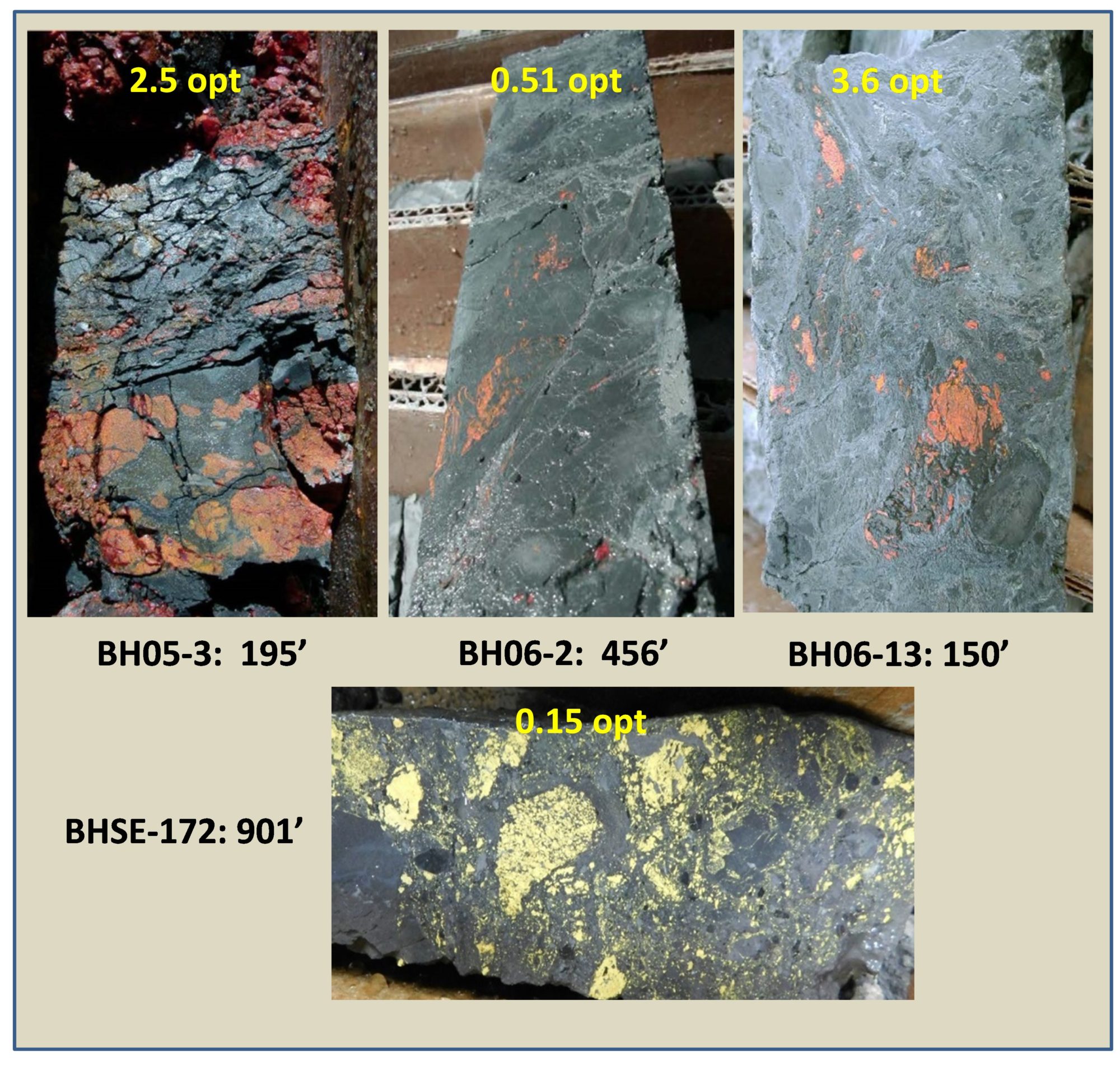

The district-scale gravity survey was completed by MaGee Geophysical Services LLC with analysis by Wright Geophysics Inc. It detailed a grid area around the historic Lookout Mountain open-pit area (Figure 1) and defined a circular gravity low at Lookout Mountain (Figure 3). The gravity low is approximately two km in diameter and is bounded and cut by several complex internal structures. The west margin of the low is coincident with jasperoid alteration and gold mineralization along the Lookout Mountain Fault.

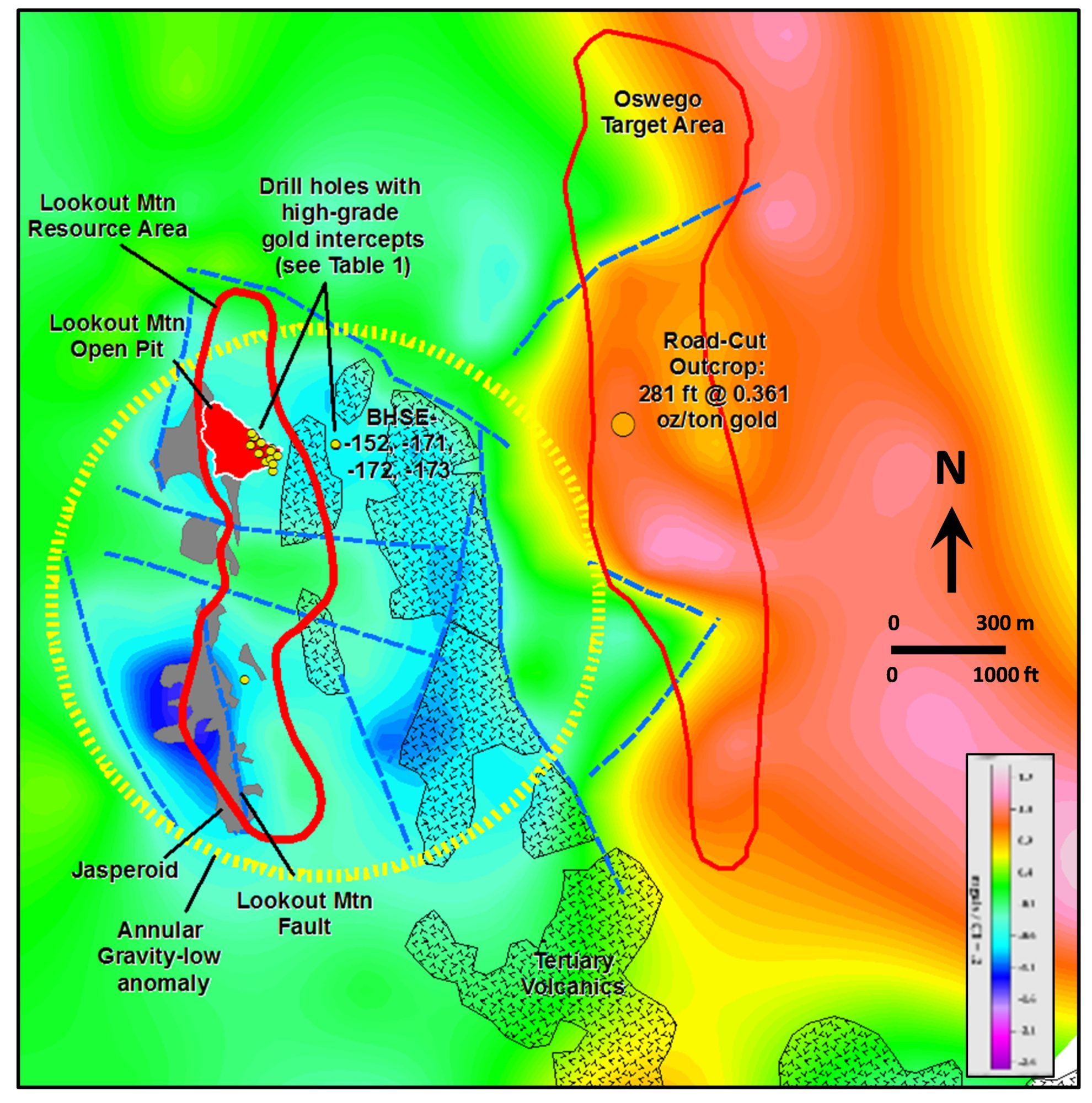

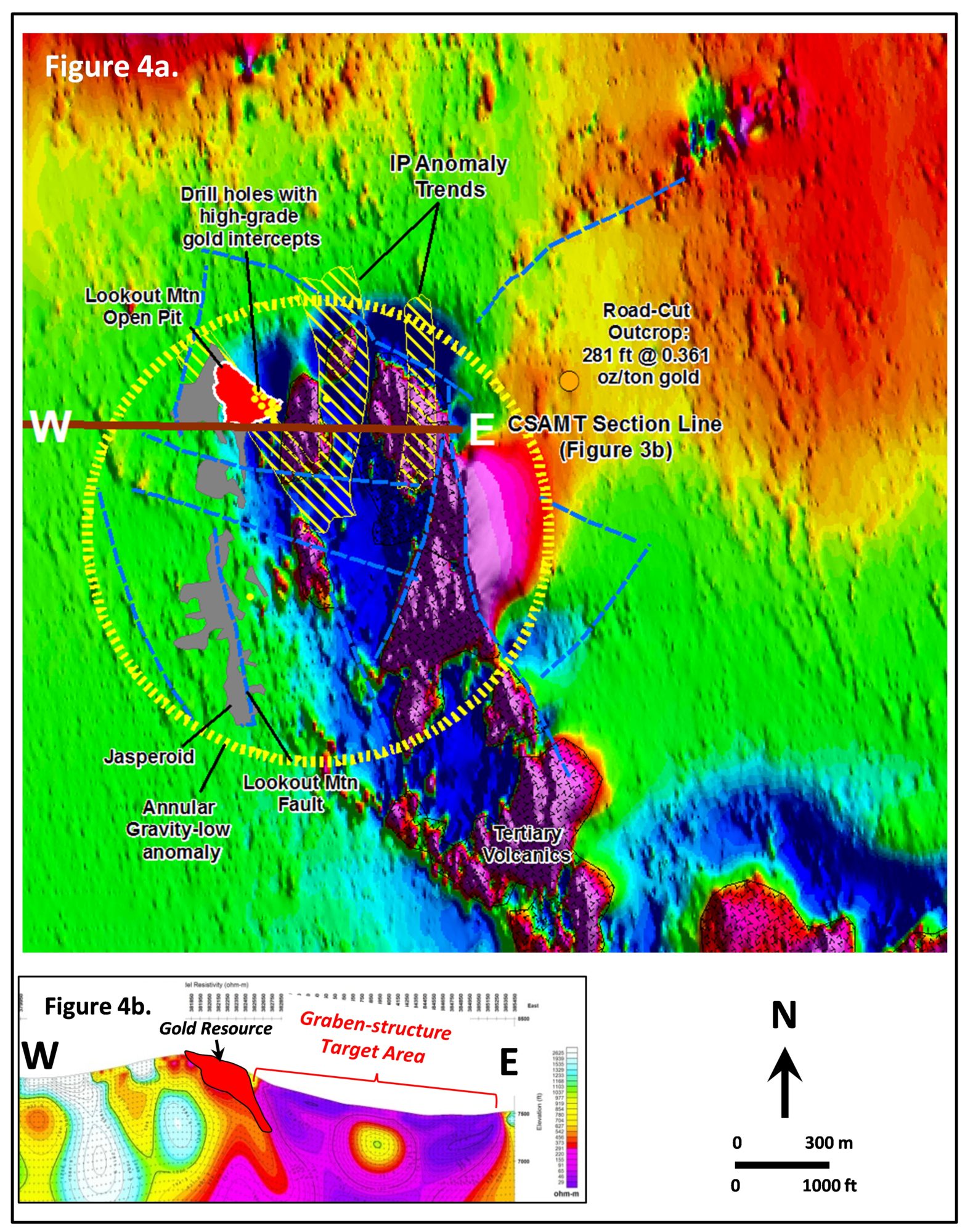

The gravity anomaly at Lookout Mountain correlates well with results of the reduced-to-pole (RTP) airborne magnetics survey (Figure 4) and geologic mapping. Major structures identified by magnetics and mapping bound the gravity anomaly.

Three lines of historic (1992) IP data at Lookout Mountain define three N-S trending anomalies (Figure 4a) which are coincident with the high-grade gold drill intercepts (Table 1) and fault structures.

Figure 1. Eureka Property Total Field Magnetics, Target Areas, and Gravity Survey

*Cautionary Statement: The potential quantity and grade of the Windfall Zone Target are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain if further exploration will result in the target being delineated as a mineral resource.

Table 1. High Grade Gold Drill Intercepts from the Lookout Mountain Deposit

A single line of historic Controlled Source Audio Magneto-Telluric (CSAMT) data (Figure 4a), collected in 1994 by Quantec Ltd., crosses the Lookout Mountain historic open-pit area. The CSAMT section (Figure 4b) identifies structures and correlates well with magnetic signatures (Figure 4a) and geologic mapping. In particular, the CSAMT data identify a high-resistivity feature spatially associated with jasperoid along the west boundary of an area of low resistivity interpreted to be a graben. The graben’s west boundary is extensively drilled and hosts the existing north-south trending gold resource at Lookout Mountain. The central portion of the graben (Figure 4b) contains a large, high-resistivity anomaly, which has only been tested locally on the west side by only four closely-spaced holes (BHSE-152, -171, -172, -173), all of which contain relatively high-grade gold (Table 1). The gold is associated with vein-like and brecciated arsenic sulfides within carbonaceous breccia, above extensively altered (“sanded” and veined) limestone, and below altered shale. The east boundary of the graben structure remains undrilled.

Cautionary Statement

Apart from recently collected gravity data, all other geophysical data are considered “historical” and do not conform to NI43-101 standards. These data include airborne magnetics, IP, and CSAMT. The data have been reviewed by the Company’s Qualified Person for consistency with geology and drill information as reported in the Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, Filed on SEDAR April 12, 2013.

Figure 2. High-Grade Gold Mineralization Drill Core from Lookout Mountain showing Heterolithic Collapse Breccia including Arsenic-sulfdes (Realgar (red) and Orpiment (yellow)).

Exploration Plans

The company is developing plans for an additional CSAMTsurvey to further define untested structures similar to the Lookout Mountain Fault for drilling.

In this regard, an application to drill up to 50 holes is being prepared under the existing Plan of Operations with the Bureau of Land Management. Approval is expected during the 4th quarter of 2018.

Qualified Person Review

Steven Osterberg, Ph.D., P.G., Timberline’s President and Chief Executive Officer, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release. Mr. Osterberg is not considered independent of the Company as defined in Section 1.5 of NI 43-101.

Figure 3. Residual Gravity at the Lookout Mountain Project, Eureka Property

Figures 4a. Lookout Mountain area RTP Magnetics with Summary IP Anomaly Trends, and (4b) CSAMT cross-section with Target Area.

About Timberline Resources

Timberline Resources Corporation is focused on advancing district-scale gold exploration and development projects in Nevada, including its 23 square-mile Eureka property, comprised of the Lookout Mountain, Windfall, and Oswego projects which lie along three separate structural stratigraphic trends defined by distinct geochemical gold anomalies; and as the operator of two joint venture projects – the Paiute project joint venture with a subsidiary of Barrick Gold, and the Elder Creek project joint venture with McEwen Mining. All of these properties lie on the prolific Battle Mountain-Eureka gold trend. Timberline also owns the Seven Troughs property in Northern Nevada, known to be one of the state’s highest grade, former producers. Timberline has increased its owned and controlled mineral rights in Nevada to over 43 square miles (27,500 acres). Detailed maps and NI 43-101 estimated resource information for the Eureka property may be viewed at https://timberlineresources.co/.

Timberline is listed on the OTCQB where it trades under the symbol “TLRS” and on the TSX Venture Exchange where it trades under the symbol “TBR”.

Forward-looking Statements

Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These include, but are not limited to, statements regarding the advancement of projects, and exploration potential. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target”, “intend” and “expect” and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. There are no assurances that the Company will complete the earn-in on the Elder Creek project as contemplated or at all. Factors that could cause or contribute to risks involving forward-looking statements include, but are not limited to, changes in the Company’s business and other factors, including risk factors discussed in the Company’s Form 10-Q for the quarter ended June 30, 2018. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Cautionary Note to U.S. Investors Regarding Mineral Reserve and Resource Estimates

Certain of the technical information referenced in this press release uses the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. We advise investors that these terms are defined in and required to be disclosed in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended; however, these terms are not defined terms under the United States Securities and Exchange Commission’s (the “SEC”) Industry Guide 7 (“Guide 7”) and are normally not permitted to be used in reports and registration statements filed with the SEC. Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by Guide 7 standards as in place tonnage and grade without reference to unit measures. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. As a reporting issuer in Canada, we are required to prepare reports on our mineral properties in accordance with NI 43-101. Investors are cautioned not to assume that any part or all of mineral deposits in the above categories will ever be converted into Guide 7 compliant reserves.

For Further Information Please Contact:

Steven A. Osterberg

President and CEO

Tel: 208-664-4859

E-mail: [email protected]

Website: www.timberline-resources.com