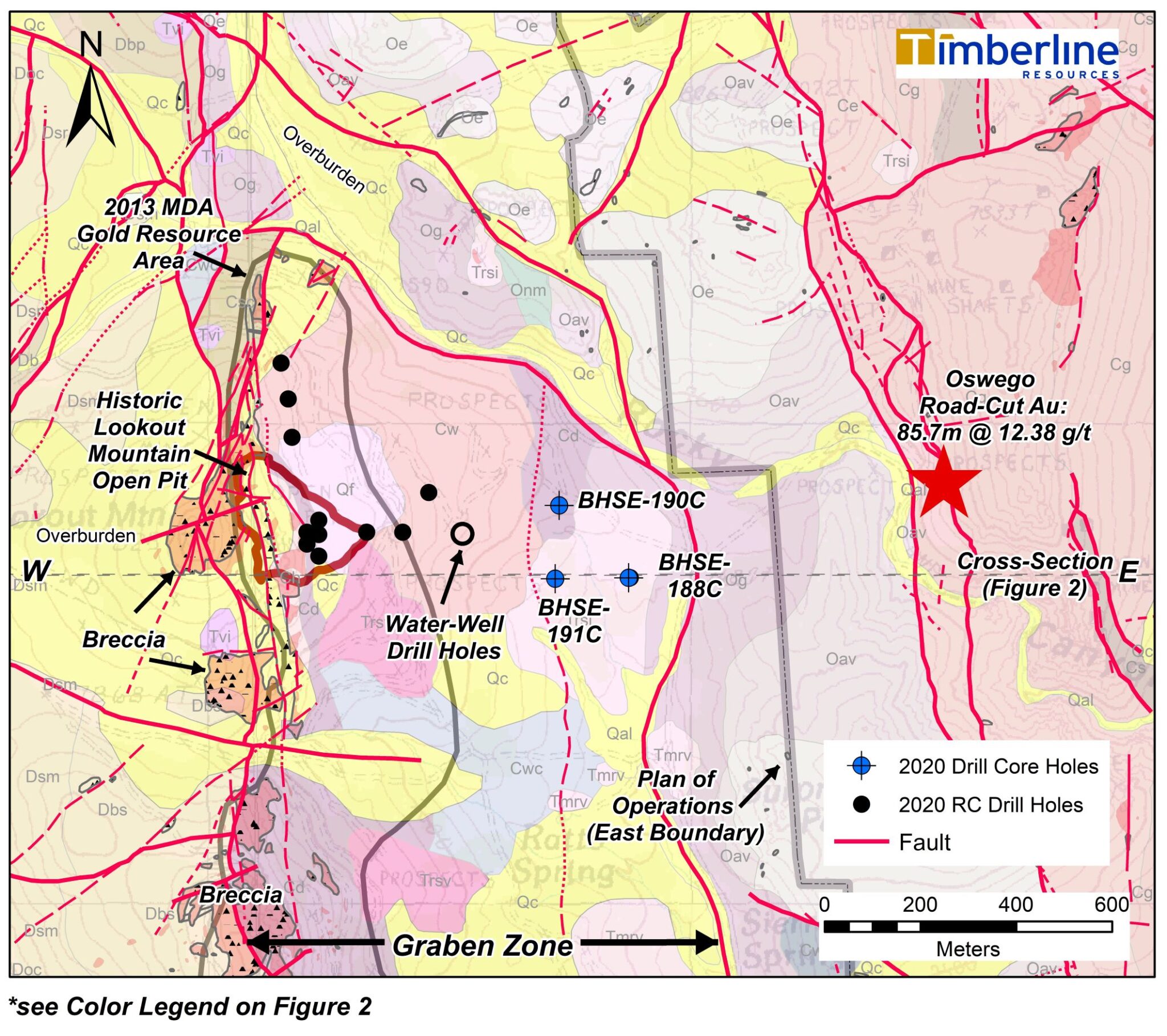

Coeur d’Alene, Idaho – March 25, 2021 – Timberline Resources Corporation (OTCQB: TLRS; TSX-V: TBR) (“Timberline” or the “Company”) announced today final results from the 2020 drilling program at its 100%-controlled Eureka Project in Nevada. The Company completed the program in December 2020 after a total of approximately 3,800 meters, comprised of 2,438m of reverse circulation (RC) and 1,365m of diamond core drilling (see Company news releases dated December 1, 2020 and January 7, 2021). The three (3) core holes (BHSE-188C, -190C, and 191C) were significant step-outs to the east targeting the down dip expansion of the Lookout Mountain mineralization (see Figure 1).

After careful logging and three-dimensional geological analysis, it is now apparent that the core holes were not drilled sufficiently deep to test the rock units that host the known high-grade (≥ 3 g/t) gold in the Lookout Deposit. The drilling did not encounter significant gold mineralization (>0.3 g/t), but the drill core does exhibit abundant alteration and thick intercepts of anomalous Carlin-Type gold, plus low-level silver-lead-zinc mineralization.

Key Results:

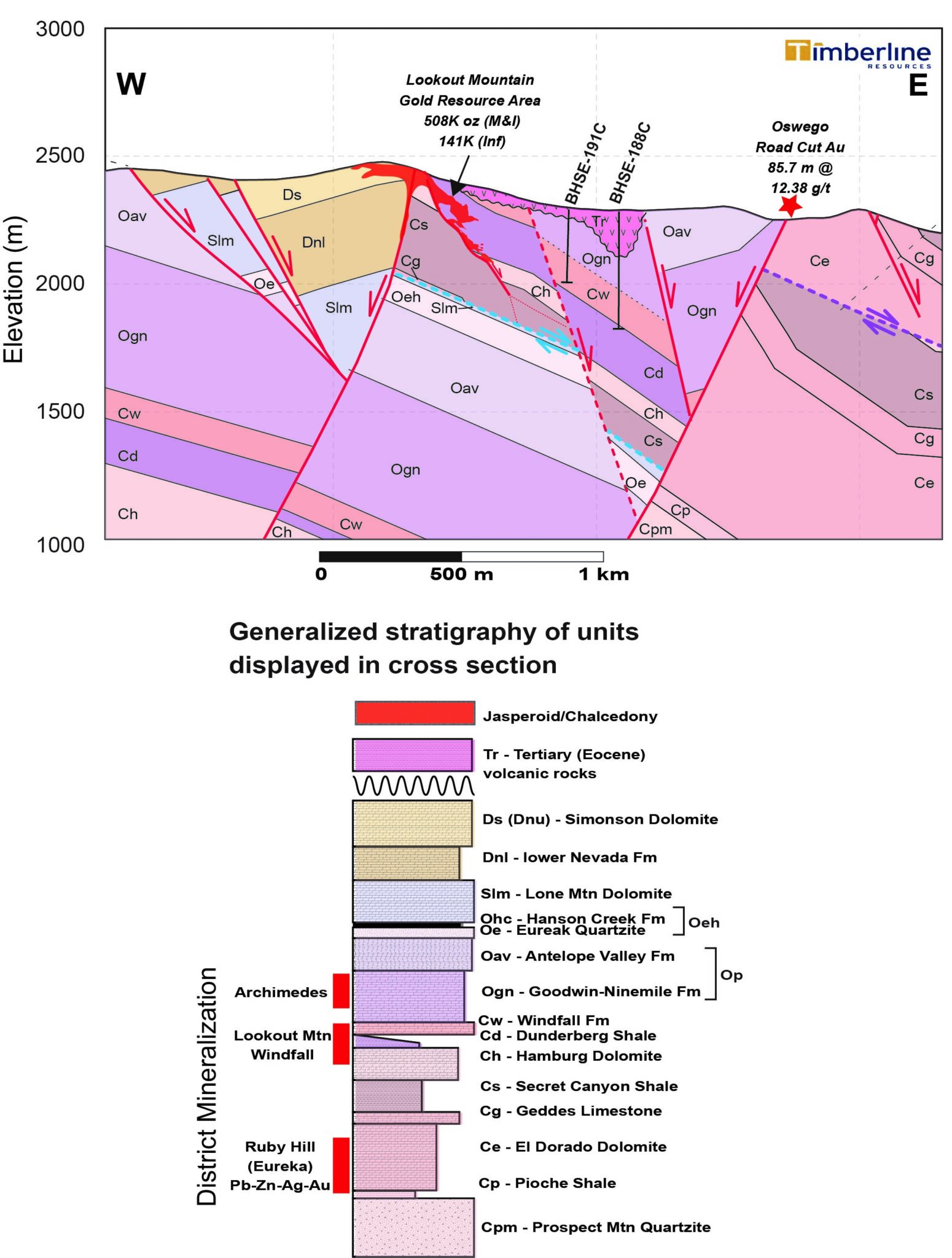

- Confirmed the presence of additional normal faulting through the Graben Zone that may host opportunities for high-grade gold along trend and at depth (Figure 2);

- Intercepted significant pyrite that is consistent with a halo above and around the IP chargeability anomaly previously reported (see Company news release dated February 3, 2021);

- Intercepted highly anomalous gold (up to 0.223 g/t) and silver (up to 86 g/t) in several intervals; and

- Gathered mounting evidence that Lookout Mountain is a close analogue to the multi-million-ounce Archimedes – Ruby Hill1,2 Mine, located 12 km to the north, including:

- Brecciated limestone, carbonaceous and pyritic breccias, dolomitized carbonates, silicification, and altered felsic intrusive rocks;

- Lead (up to 0.34%), zinc (up to 0.57%), and silver mineralization with anomalous gold and a proximal association with Carlin-Type gold mineralization.

Patrick Highsmith, Timberline’s President and CEO commented, “Along with our recently reported geophysical anomalies, these step-out exploration core holes at our Lookout Mountain target provide important evidence that there are large overlapping mineral systems at depth. We are also now aware of more faults cutting through the favorable Carlin-Type host stratigraphy. The interaction of these faults with the right host rocks are excellent targets for high-grade gold such as that we drilled in the main resource area and in the Water Well Zone in 2020. Work is well underway to present numerous attractive drill targets for 2021 at the Lookout Target and other analogous settings.”

Figure 1 – Lookout Mountain Target at Eureka Gold Project Showing 2020 Graben Zone Drilling

Drilling and Geological Details

Each of the three diamond core holes discussed in this release were drilled as vertical holes. Their depth and collar coordinates are shown in Table 1.

These core holes were designed to be significant step-outs from known mineralization into a target area called the Graben Zone. In this area, the favorable host rocks from the Lookout Mountain deposit dip east beneath younger sedimentary and volcanic rocks. The mineralized horizons were interpreted to be present, but the Timberline team also inferred faults through the area that may disrupt potential mineralization at depth. These faults may also provide plumbing for gold bearing fluids and host high-grade gold in the associated breccias, as seen at the Lookout Deposit. The target for the deeper drilling was further bolstered by an historic induced polarization/resistivity (IP) survey on a single line nearby, which suggested the presence of sulfides or organic carbon at depth.

Table 1 – Details for 2020 Core Holes at Eureka Gold Project

|

Drillhole |

Inclination (degrees) | Easting (meters) |

Northing (meters) | Total Depth*(meters) | Estimated Step-out**(meters) |

| BHSE – 188C | -90 | 586,794 | 4,362,886 | 471.7 | 435 |

| BHSE – 190C | -90 | 586,652 | 4,363,031 | 525.9 | 350 |

| BHSE – 191C | -90 | 586,603 | 4,362,880 | 367.0 | 230 |

| * Drilling and sampling conducted in feet. Intervals are converted from feet to meters for reporting. ** Approximate distance from collar location to eastern margin of Lookout Mountain Resource. |

|||||

The three core holes passed through similar geology. The thickness of younger volcanics in the area varied from approximately 35m to 175m. Beneath the volcanics, the drilling encountered limestones that began as well-bedded and oxidized but included increasing shale interbeds at depth. Fracturing and veining also increased with depth, often indicating the presence of faulting. Drill holes BHSE-188C and -190C included significant intervals of black sulfide-matrix breccia and oxidized dolomites before bottoming in fine-grained silicified and pyritic intrusive dikes of variable thickness. Drill hole BHSE-191C was lost in highly fractured rock before reaching its target depth.

The anomalous gold was associated primarily with decalcified limestones and with black matrix breccias. The subtle silver-lead-zinc mineralization is most often associated with veining in dolomite, jasperoid breccias, and silicified and stockwork-veined fine-grained dikes. This style of silver-lead-zinc mineralization may indicate the presence of a carbonate-replacement-deposit (CRD) nearby. The Eureka District is known for CRDs that were deposited much earlier in time than the Carlin-Type gold mineralization.

Using the surface geological mapping, drill logs, and biostratigraphic information from fossils, the Timberline team has prepared a new geological cross section through the Lookout Mountain Area (see Figure 2). The cross section shows that the Dunderberg Shale and other host rocks from the Lookout Resource are down-dropped by east-dipping normal faults cutting through the target area. It is now apparent that this core drilling was not sufficiently deep to test the rocks that host the Lookout mineralization.

The IP geophysics reported in February also indicates that the heart of the chargeability anomaly is below the depth of drilling in the Graben Zone. However, there are lobes of high chargeability that rise closer to the surface, both north and south of the 2020 drilling. These shallower IP anomalies will be among the near-term drill targets at Lookout and in the Graben Zone.

Figure 2 – Geological Cross Section through Lookout Mountain Target with 2020 Core Drilling

The construction of the cross section has also shown that many other favorable targets exist where Carlin-Type host rocks are cut by abundant faults within the Lookout Trend. The team is currently preparing a work program for 2021 that will target potential settings for high-grade Carlin-Type gold mineralization in the Lookout, South Lookout, and Rocky Canyon areas. Additional three-dimensional geologic work is underway to demonstrate the best target analogies to the high-grade setting at Lookout Mountain.

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance

Collection of diamond drill core was completed under the supervision of a Company representative. Personnel from Timberline or the drilling contractors transported the core samples to Timberline’s secure Eureka facility. Senior geologists directed the cutting and sampling of the core and selection of representative samples for assay. Quality control was monitored by the insertion of numerous blind certified standard reference materials, field duplicates, and blanks into each sample shipment. Company representatives completed sample dispatch paperwork and delivered the samples to ALS USA Inc. (ALS) in Elko, Nevada for sample preparation. Drill samples were assayed by ALS in Reno, Nevada for gold by fire assay of a 30-gram charge with an AA or ICP-ES finish (ALS code Au-AA23). The overlimits for gold samples assaying above 10 g/t were determined by a 30-gram fire assay with gravimetric finish. In addition, visibly altered samples were submitted for multi-element analysis (33 elements) by four-acid digestion and ICP-ES determination (code ME-ICP61).

According to Timberline instruction, samples assaying above 0.2 g/t gold were also tested for cyanide-soluble gold with the 30-gram Au-AA13 method. This form of analysis is a preliminary indication of the favorability of the sample for gold recovery by cyanide leach. Since the test is performed on a small aliquot of a pulverized sample, it is not a reliable indication of metallurgical recovery.

Steven Osterberg, Ph.D., P.G., Timberline’s Vice President Exploration, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release. Dr. Osterberg is not independent of the Company as he is an officer and a director.

1 – The Archimedes – Ruby Hill Mine was operated historically by Homestake Mining and Barrick Gold. Historical production was approximately 1.4 million ounces and remaining resources are estimated at 3.9 million ounces of gold. The project is currently operated by Ruby Hill Mining Company LLC, a subsidiary of Waterton Precious Metals Fund II. Sources: Waterton Global Resource Management and www.miningdataonline.com

2 – Timberline cautions that proximity or similar geology to an active or past-producing mine does not indicate that mineralization will occur on Timberline’s property, and if present, that it will occur in sufficient quantity or grade that would be economic to mine. This information is provided for context and as an element of the prospectivity analysis of the Company’s properties.

About Timberline Resources

Timberline Resources Corporation is focused on delivering high-grade Carlin-Type gold discoveries at its district-scale Eureka Project in Nevada. The Eureka Property includes the historic Lookout Mountain and Windfall mines in a total property position of approximately 24 square miles (62 square kilometers). The Lookout Mountain Resource was reported in compliance with Canadian NI 43-101 in an Updated Technical Report on the Lookout Mountain Project by Mine Development Associates, Effective March 1, 2013, filed on SEDAR April 12, 2013.

| Resource Category | Tonnage (million short tons) |

Grade (oz/ton) |

Grade (grams/tonne) |

Contained Au (troy oz) |

| Measured | 3.04 | 0.035 | 1.2 | 106,000 |

| Indicated | 25.90 | 0.016 | 0.6 | 402,000 |

| Inferred | 11.71 | 0.012 | 0.41 | 141,000 |

The Company is also operator of the Paiute Joint Venture Project with Nevada Gold Mines in the Battle Mountain District. These properties lie on the prolific Battle Mountain-Eureka gold trend. Timberline also controls the Seven Troughs Project in northern Nevada, which is one of the state’s highest-grade former gold producers. Timberline controls over 43 square miles (111 square kilometers) of mineral rights in Nevada. Detailed maps and mineral resources estimates for the Eureka Project and NI 43-101 technical reports for its projects may be viewed at https://timberlineresources.co/.

Timberline is listed on the OTCQB where it trades under the symbol “TLRS” and on the TSX Venture Exchange where it trades under the symbol “TBR”.

Forward-looking Statements: Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These include, but are not limited to, statements regarding the advancement of projects, and exploration potential. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target”, “intend”, “growth opportunity” and “expect” and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to risks involving forward-looking statements include, but are not limited to, changes in the Company’s business and other factors, including risk factors discussed in the Company’s Form 10-K for the year ended September 30, 2020. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

On behalf of the Board of Directors,

“Patrick Highsmith”

President and CEO

Tel: 208-664-4859