Coeur d’Alene, Idaho – June 30, 2020 – Timberline Resources Corporation (OTCQB: TLRS; TSX-V: TBR) (“Timberline” or the “Company”) has issued a notice of default to PM & Gold Mines, Inc. (“PM&G”) pursuant to terms of the Lookout Mountain Joint Venture Agreement. The Agreement allows PM&G to earn an initial 51% interest in the project by funding $6 million in work expenditures over a 2-year period (see press release dated July 11, 2019 at https://timberlineresources.co/press-releases), of which $3 million was to have been expended during the first year. PM&G has 30 days from June 28, 2020 to cure the default by making an in-lieu cash payment to Timberline of approximately $2.24 million.

Steven Osterberg, Timberline’s President and CEO, stated, “Lookout is a large Carlin-type gold system associated with a surface footprint of at 4-5 km along trend and ≥1 km width. The current NI 43-101 compliant gold resource of 508,000 oz Measured & Indicated and 141,000 oz Inferred remains open in all directions. We plan to expand the resource mineralization and to delineate and extend zones high-grade gold mineralization within it. With the improved capital markets, we look forward to advancing the project at the conclusion of the cure period.”

Lookout Mountain Project

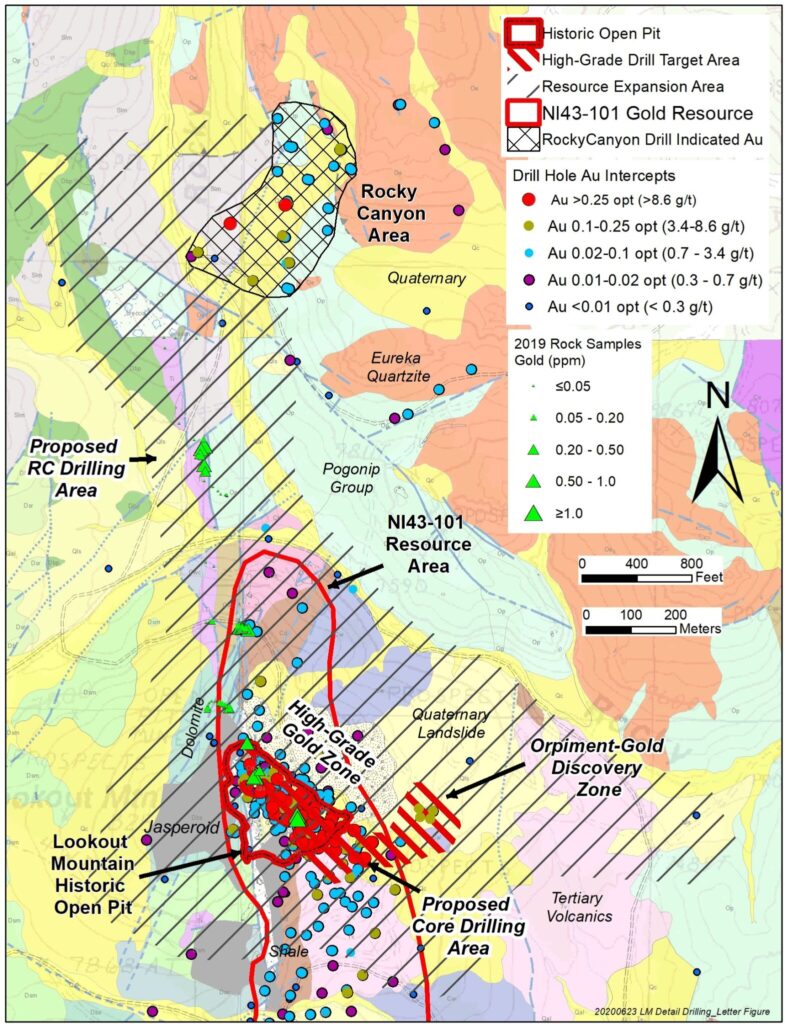

Past core and rotary drilling at Lookout Mountain partially delineated a trend of high-grade (intercepts of ≥0.10 ounces/ton (opt) (3.43 grams/tonne (g/t)) gold mineralization in the historical open-pit mine area (Figure 1), which produced 17,700 ounces of gold averaging 0.12 opt (4.11 g/t) in 1987 (see also press releases dated July 11, 2019 and September 4, 2019 at https://timberlineresources.co/press-releases and Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, filed on SEDAR April 12, 2013). The drilling includes 46 intercepts in 38 drill holes (Table 1) of ≥ 0.25 opt (8.6 g/t) gold. The high-grade gold mineralization occurs in relatively flat-lying to steep-dipping zones where structures intersect favorable stratigraphy. Associated alteration includes decalcification, collapse breccias, jasperoid, and chalcedonic silicification, which are characteristic of major Carlin-type gold deposits.

Plans include reverse circulation (RC) and core drilling. The core drilling will test continuity of the high-grade mineralization and provide important technical information. Some core holes will twin selected historical RC and conventional rotary holes to compare gold grades and recoveries. In addition, RC drilling will test for shallow, oxide gold mineralization north of the historic pit including a largely untested gap of approximately 1,500 ft (~450 m) between the current NI 43-101 resource and the Rocky Canyon mineralized area. It will also step out around the “orpiment-gold” high-grade mineralization discovered by drilling east of the pit area in 2015 (see press release dated April 20, 2015 at https://timberlineresources.co/press-releases).

Figure 1. Lookout Mountain Open Pit-area Drill Holes, High-grade Gold Intercepts and Proposed Drilling Areas

Table 1. Lookout Mountain High-grade Gold (≥ 0.25 opt (8.6 g/t)) Drill Intercepts1

|

Drill |

Gold (opt) |

From (feet) |

To |

Interval (feet) | Gold (g/t) |

From (meters) | To (meters) | Interval (meters) | |

| BH05-01 | 0.370 | 270 | 330 | 60 | 12.7 | 82.3 | 100.6 | 18.3 | |

| BH05-03 | 2.24 | 193 | 196 | 3 | 76.8 | 58.8 | 59.8 | 0.9 | |

| BH06-02 | 0.360 | 445 | 472 | 27 | 12.4 | 135.7 | 143.9 | 8.2 | |

| BH06-10 | 0.537 | 0 | 50 | 50 | 18.4 | 0.0 | 15.2 | 15.2 | |

| BH06-13 | 1.47 | 148 | 151 | 3 | 50.3 | 45.1 | 46.0 | 0.9 | |

| BH06-13 | 0.277 | 385 | 409.5 | 24.5 | 9.51 | 117.4 | 124.9 | 7.5 | |

| BH06-16 | 0.376 | 0 | 32.7 | 32.7 | 12.9 | 0.0 | 10.0 | 10.0 | |

| BHSE-029C | 0.349 | 391 | 449 | 58 | 12.0 | 119.2 | 136.9 | 17.7 | |

| BHSE-032 | 0.425 | 140 | 150 | 10 | 14.6 | 42.7 | 45.7 | 3.1 | |

| BHSE-034 | 0.460 | 135 | 140 | 5 | 15.8 | 41.2 | 42.7 | 1.5 | |

| BHSE-037C | 0.810 | 222 | 223 | 1 | 27.8 | 67.7 | 68.0 | 0.3 | |

| BHSE-126C | 0.967 | 31 | 46.2 | 15.2 | 33.1 | 9.5 | 14.1 | 4.6 | |

| BR-1 | 0.424 | 35 | 75 | 40 | 14.5 | 10.7 | 22.9 | 12.2 | |

| BR-1 | 1.32 | 65 | 75 | 10 | 45.1 | 19.8 | 22.9 | 3.1 | |

| BR-19 | 0.323 | 220 | 235 | 15 | 11.1 | 67.1 | 71.7 | 4.6 | |

| BR-19 | 0.319 | 385 | 450 | 65 | 10.9 | 117.4 | 137.2 | 19.8 | |

| BR-26 | 0.323 | 440 | 460 | 20 | 11.1 | 134.2 | 140.2 | 6.1 | |

| EFL-4 | 0.270 | 95 | 100 | 5 | 9.3 | 29.0 | 30.5 | 1.5 | |

| EFL-5 | 0.250 | 0 | 5 | 5 | 8.6 | 0.0 | 1.5 | 1.5 | |

| LM-05 | 0.259 | 0 | 65 | 65 | 8.9 | 0.0 | 19.8 | 19.8 | |

| LM-13 | 0.360 | 10 | 15 | 5 | 12.3 | 3.1 | 4.6 | 1.5 | |

| RTC-201 | 0.317 | 0 | 46 | 46 | 10.9 | 0.0 | 14.0 | 14.0 | |

| RTC-201 | 0.504 | 57 | 65 | 8 | 17.3 | 17.4 | 19.8 | 2.4 | |

| RTR-020 | 0.520 | 20 | 25 | 5 | 17.8 | 6.1 | 7.6 | 1.5 | |

| RTR-044 | 0.338 | 0 | 65 | 65 | 11.6 | 0.0 | 19.8 | 19.8 | |

| RTR-044a | 0.290 | 0 | 10 | 10 | 9.94 | 0.0 | 3.1 | 3.1 | |

| RTR-044a | 0.310 | 85 | 90 | 5 | 10.6 | 25.9 | 27.4 | 1.5 | |

| RTR-048 | 0.400 | 180 | 185 | 5 | 13.7 | 54.9 | 56.4 | 1.5 | |

| RTR-049 | 4.76 | 110 | 115 | 5 | 163 | 33.5 | 35.1 | 1.5 | |

| RTR-049 | 0.820 | 240 | 250 | 10 | 28.1 | 73.2 | 76.2 | 3.1 | |

| RTR-059 | 0.600 | 95 | 105 | 10 | 20.6 | 29.0 | 32.0 | 3.1 | |

| RTR-071 | 0.283 | 0 | 45 | 45 | 9.71 | 0.0 | 13.7 | 13.7 | |

| RTR-095 | 0.368 | 25 | 65 | 40 | 12.6 | 7.6 | 19.8 | 12.2 | |

| RTR-098 | 0.370 | 0 | 45 | 45 | 12.7 | 0.0 | 13.7 | 13.7 | |

| RTR-133 | 0.507 | 235 | 250 | 15 | 17.4 | 71.7 | 76.2 | 4.6 | |

| RTR-134 | 0.350 | 415 | 470 | 55 | 12.0 | 126.5 | 143.3 | 16.8 | |

| RTR-153 | 0.325 | 30 | 60 | 30 | 11.1 | 9.2 | 18.3 | 9.2 | |

| RTR-153 | 0.360 | 240 | 245 | 5 | 12.3 | 73.2 | 74.7 | 1.5 | |

| RTR-156 | 0.300 | 55 | 60 | 5 | 10.3 | 16.8 | 18.3 | 1.5 | |

| RTR-159 | 0.250 | 15 | 25 | 10 | 8.57 | 4.6 | 7.6 | 3.1 | |

| RTR-163 | 0.920 | 60 | 65 | 5 | 31.5 | 18.3 | 19.8 | 1.5 | |

| RTR-180 | 0.340 | 365 | 375 | 10 | 11.7 | 111.3 | 114.3 | 3.1 | |

| RTR-181 | 0.265 | 265 | 335 | 70 | 9.09 | 80.8 | 102.1 | 21.3 | |

| RTR-190 | 0.329 | 475 | 525 | 50 | 11.3 | 144.8 | 160.1 | 15.2 | |

| RTR-191 | 0.557 | 440 | 485 | 45 | 19.1 | 134.2 | 147.9 | 13.7 | |

| RTR-258 | 0.410 | 500 | 510 | 10 | 14.1 | 152.4 | 155.5 | 3.1 |

1 See Updated Technical Report on the Lookout Mountain Project, MDA, Effective March 1, 2013, Filed on SEDAR April 12, 2013 for sample preparation, analyses, and security, and data verification

Lookout Mountain Gold Resource

Plans are to incorporate the results of the drilling to update the resource model prepared by Mine Development Associates (“MDA”) of Reno, Nevada in 2013 (Table 2).

| Table 2. Lookout Mountain Gold Resource(1)(2)(3) | |||||

| Resource Category | Tons | Tonnes | Gold (opt) | Gold (g/t) |

Gold Ounces |

| Measured | 3,043,000 | 2,761,000 | 0.035 | 1.200 | 106,000 |

| Indicated | 25,897,000 | 23,493,000 | 0.016 | 0.549 | 402,000 |

| Measured & Indicated | 28,940,000 | 26,254,000 | 0.018 | 0.617 | 508,000 |

| Inferred | 11,709,000 | 10,622,000 | 0.012 | 0.411 | 141,000 |

Notes:

(1) 006 opt (0.21 g/t) cut-off applied to oxidized material to capture mineralization potentially available to open pit extraction and heap leach processing. 0.030 opt (1.03 g/t) cut-off applied to unoxidized material to capture mineralization potentially available to open pit extraction and lower heap leach recoveries or sulfide processing.

(2) Rounding may cause apparent discrepancies.

(3) Refer to Updated Technical Report on the Lookout Mountain Project, MDA, effective March 1, 2013, Filed on SEDAR April 12, 2013.

The full MDA resource study can be seen at https://timberlineresources.co/wp-content/uploads/2015/07/LookoutMt_-43-101_2013.pdf

About Timberline Resources:

Timberline Resources Corporation is focused on advancing district-scale gold exploration and development projects in Nevada. These include the Lookout Mountain joint venture project with PM & Gold Mines operated by Timberline and the Windfall project, both in the Eureka district. The Company is operator of both the Paiute joint venture project with Nevada Gold Mines, and the Elder Creek joint venture with McEwen Mining, both in the Battle Mountain district. These properties all lie on the prolific Battle Mountain-Eureka gold trend. Timberline also owns the Seven Troughs property in Northern Nevada, which is one of the state’s highest-grade former gold producers. Timberline controls over 43 square miles (27,500 acres) of mineral rights in Nevada. Detailed maps and NI 43-101 estimated resource information for the Eureka property and NI 43-101 technical reports for the Elder Creek and Paiute projects may be viewed at https://timberlineresources.co/.

Timberline is listed on the OTCQB where it trades under the symbol “TLRS” and on the TSX Venture Exchange where it trades under the symbol “TBR”.

Forward-looking Statements: Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These include, but are not limited to, statements regarding the advancement of projects, and exploration potential. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target”, “intend” and “expect” and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. There are no assurances that the Company will complete the earn-in on the Elder Creek project as contemplated or at all. Factors that could cause or contribute to risks involving forward-looking statements include, but are not limited to, changes in the Company’s business and other factors, including risk factors discussed in the Company’s Form 10-Q for the quarter ended March 31, 2020. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

For Further Information Please Contact:

Steven A. Osterberg

President and CEO

Tel: 208-664-4859

E-mail: [email protected]