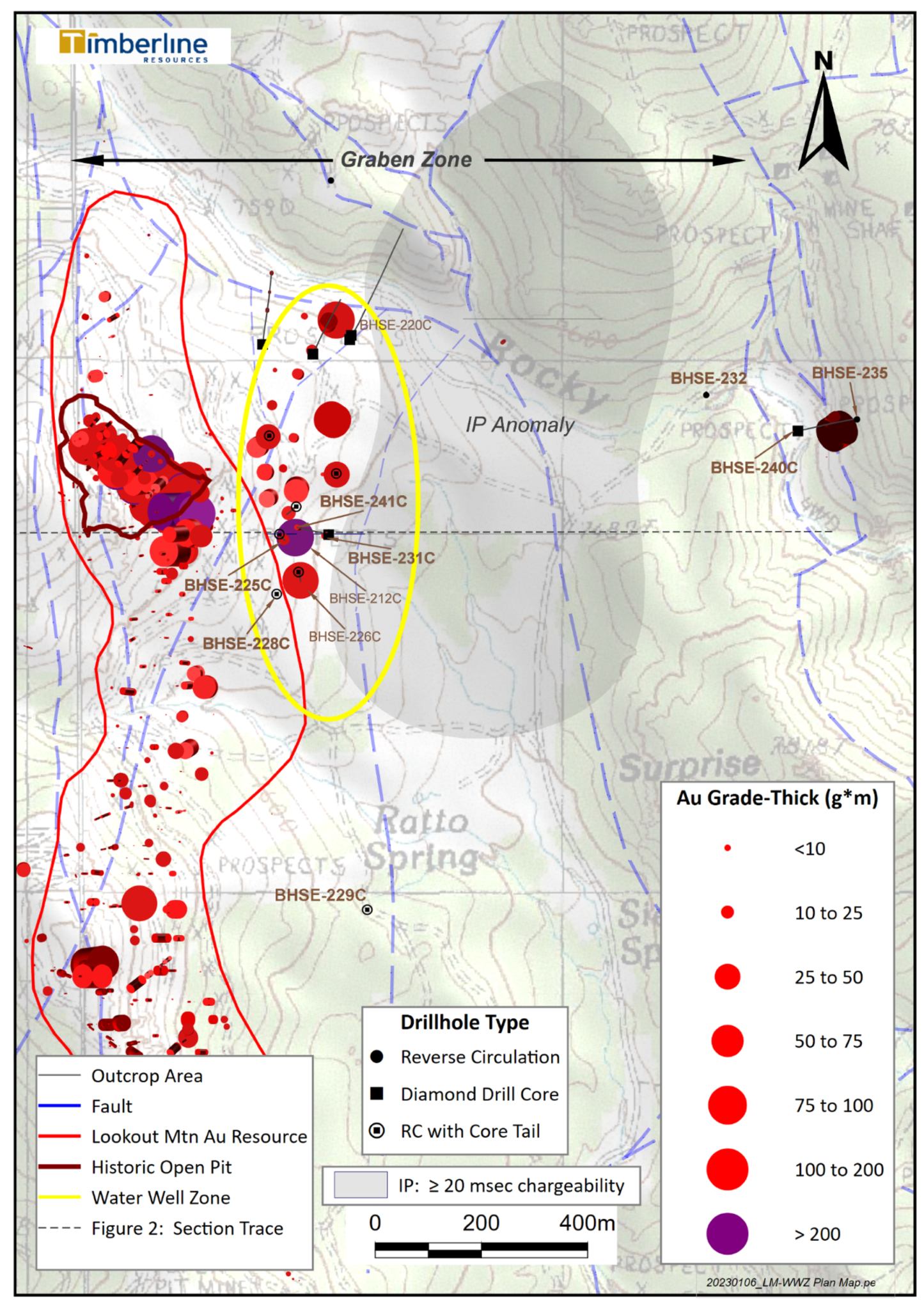

Coeur d’Alene, Idaho – January 17, 2023 – Timberline Resources Corporation (OTCQB: TLRS; TSX-V: TBR) (“Timberline” or the “Company”) reports the final drill results from the 2022 drilling program at its 100%-controlled Eureka Project in Nevada. Eight drill holes are reported here, including four from the Water Well Zone (WWZ), three from the Oswego target, and one large step out into the South Pediment area (Figure 1). Six of the eight holes were drilled with diamond core (or a pre-collar with reverse circulation and core tail), and two of the holes were completed with reverse circulation only. These eight holes constitute approximately 2,549 meters of the recently completed 6,662-meter drill program at Eureka.

Each of the holes in the WWZ encountered significant Carlin-type gold mineralization, confirming that the basal contact of the Dunderberg formation is consistently mineralized over a large area. Three drill holes (BHSE-225C, 231C, and 241C) near BHSE-212C (the best hole in the southern part of the WWZ, see Company news release dated March 24, 2022) yielded significant thicknesses of gold ranging from 8.5 to 29.0 meters.

Highlights from this phase of drilling are included below. These are drill hole widths using a cut-off grade of 0.3 g/t for gold; true thickness is not yet known:

- BHSE-225C: 29.0m at 1.06 grams per tonne (g/t) gold from 294.7m depth, including

- 9.1m at 2.17 g/t gold from 305.4m depth; and

- 1.5m at 3.01 g/t gold from 308.5m depth;

- BHSE-231C: 8.5m at 2.38 g/t gold from 303.9m depth, including

- 4.0m at 3.63 g/t gold from 308.5m depth;

- BHSE-241C: 1.5m at 3.40 g/t gold from 305.4m depth;

- BHSE-241C: 25.9m at 0.72 g/t gold from 314.6m depth; including

- 7.6m at 1.3 g/t gold from 314.6m depth; and

- 1.5m at 3.65 g/t gold from 314.6m depth.

Patrick Highsmith, Timberline’s President and CEO commented, “These final results from the 2022 drill program reinforce the extent of the mineralization at the contact between the Dunderberg and Hamburg formations. We are consistently finding gold at this contact, but it’s also clear that the numerous faults are creating gaps, as well as zones of enrichment, in the Water Well Zone deposit. Our understanding of these faults is dramatically improved with the new core drilling, and we look forward to tapping more of the high grade with the 2023 program. We believe we are inside the footprint of a significant discovery at Water Well, and the best potential for expansion by surface drilling lies to the east and south.”

Figure 1 – Plan View of New Drilling along Lookout Trend and at Oswego Target

Geology and Interpretation of the WWZ Results

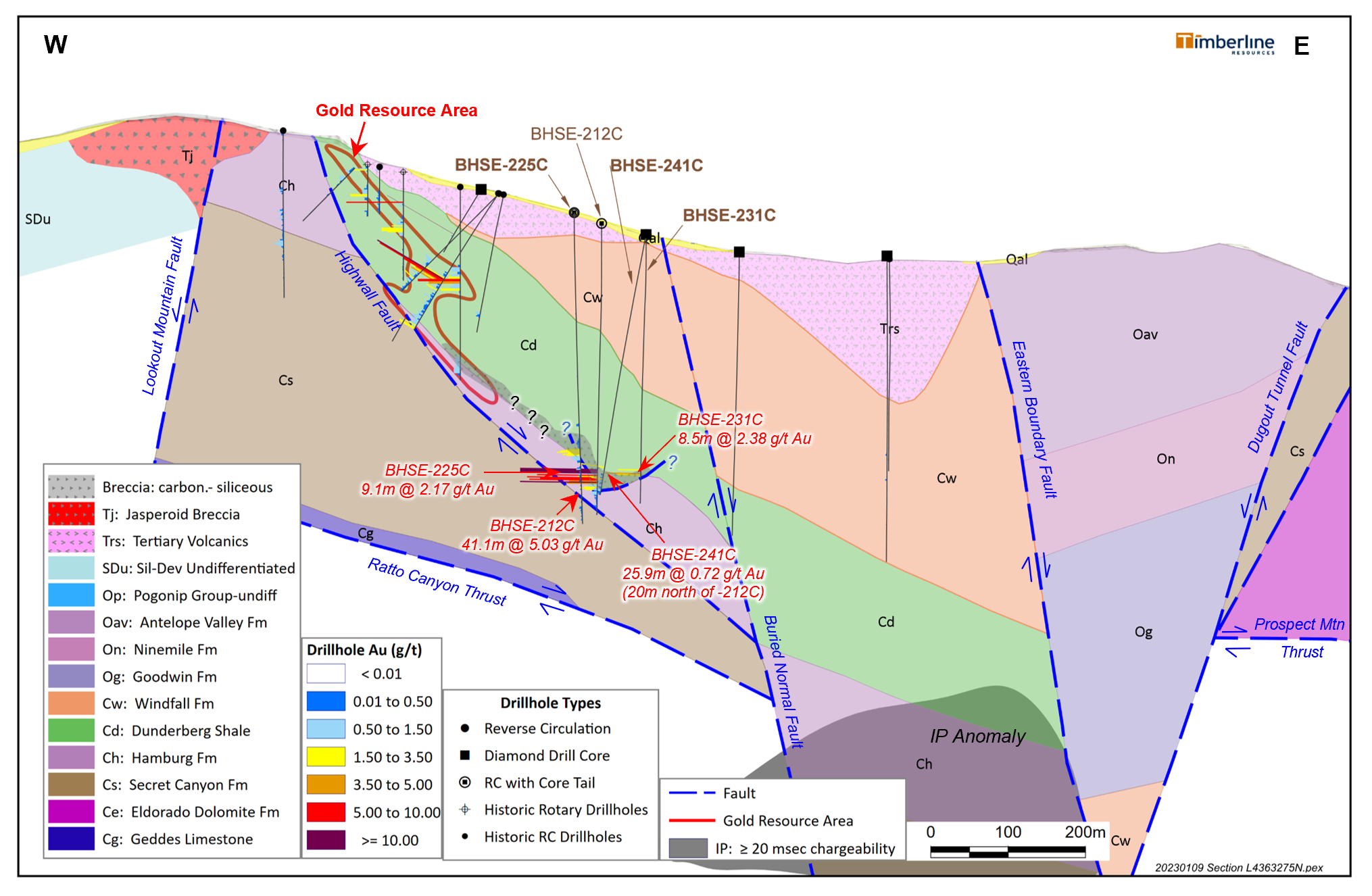

The four core holes in the southern part of the WWZ were directed at filling in the geological details around the thick zone of high-grade gold encountered in BHSE-212C. That drill hole passed through very well-developed collapse breccias at the contact between the Dunderberg and Hamburg formations that were intensely carbonized and clay-altered and infiltrated by arsenic and fine-grained pyrite. The heart of that 41.0-meter-thick interval included 19.8m averaging 9.5 g/t gold. These zones of intensely altered and mineralized breccia are believed to be best developed near faults. The latest drilling has confirmed continuity of the WWZ mineralization to the east, west, and north from BHSE-212C, but the assays also returned lower grades in each of these intercepts.

BHSE-225C was collared approximately 35m west of BHSE-212C, and BHSE-231C was located approximately 56m east of the high-grade hole. BHSE-241C was drilled inclined to the west from the same drill pad as BHSE-231C such that it penetrated the target horizon approximately 20m north of the gold intercept in BHSE-212C. The cross section in Figure 2 shows the geometry of these new drill holes relative to the earlier drill holes and the geology of the area.

Figure 2 – Cross Section of Line 4363875N through the South WWZ with New Drilling

Careful examination of the drill core and assay data suggests that the high-grade intercept in BHSE-212C occupies a topographic low or trough within the top of the Hamburg formation. The Dunderberg formation also appears to thin a bit to the east. These phenomena are most likely related to one or more faults in the area (shown in blue with question marks on the cross section), which juxtapose the key Dunderberg-Hamburg contact into close proximity with the important Highwall Fault. The position of any individual drill hole relative to these newly realized faults and the Highwall or Buried Normal faults may be a determinant of the thickness and grade of gold in this part of the WWZ. These sorts of gaps and variability in grade and thickness are expected in Carlin-type deposits when chopped into segments and offset by numerous faults.

Importantly, the high-grade zone was already extended approximately 75m to the south with drillhole BHSE-226C (22.8m at 4.39 g/t gold, including 7.6m at 11.56 g/t gold, as reported in a Company news release dated September 14, 2022). The high-grade portion of the WWZ remains untested to the south and southeast for more than 500m. Drill hole BHSE-228C in this phase of results was an offset of approximately 60m southwest from BHSE-226C. The mineralized contact was present in this hole at the expected depth, but it comprised only 15.2m of 0.57 g/t gold.

The Lookout Mountain gold resource continues for more than 1.0 kilometre south from this latest drilling. Hence, Timberline geologists expect similar downdip targets, such as the WWZ, to occur in favorable settings along its eastern front. BHSE-229C was the Company’s first attempt to chase the Dunderberg-Hamburg contact into this South Pediment area. While the drill hole did not cut significant high-grade mineralization, it did encounter 3.7m that averaged 0.63 g/t of oxide gold mineralization at the top of the Hamburg formation beneath structurally thinned Dunderberg formation. There is clear evidence of major faulting in the hole, so the team will be working to better understand the geology here before following up.

Geology and Interpretation of the Oswego Results

This round of drilling did not return significant gold results from the Oswego target. Two of the three holes (BHSE-232 and 235) in this area were RC holes aimed at testing for significant expansions of the surface and shallow drill indicated gold mineralization along this major fault structure. BHSE-232 did not encounter the western splay of the Dugout Tunnel fault as expected, so this means that a major break between Cambrian and Ordovician rocks is likely between here and the IP anomaly occupying the Graben Zone.

The location of BHSE-235 was dictated in part by road access due to the steep topography at Oswego. It was a vertical hole into the Eldorado dolomite, which is an important host of silver in the district. There was anomalous gold over about 37m of the hole, including 1.5m of 0.34 g/t, but there was silver mineralization averaging 2.25 g/t over approximately 27m. As is typical of the Carbonate Replacement Deposits (CRD) of the district, the silver is associated with elevated antimony, lead, and zinc.

Timberline also drilled the first core hole ever into the Oswego target, BHSE-240C. The hole was aimed to the east underneath the strong surface and shallow drill indicated gold reported in late 2021 and early 2022. Once again, the gold results were below expectations (29m of weakly anomalous gold with a maximum assay of 0.35 g/t), but there was a 15m zone of enriched silver (> 1.0 g/t) accompanied by antimony, lead, and zinc.

The shallow gold at Oswego remains open to the north and northeast, but it appears to occupy a complex fault system that may truncate or offset it at depth. Silicification and sulfidation are intense over a large area, and this is new evidence of CRD-type veining and replacement style mineralization that may constitute a separate target.

This completes the reporting of results from the 2022 drill campaign. Table 1 includes the location and orientation details of the drill holes reported in this release.

Table 1 – Location and Other Details for New Eureka 2022 Drill Holes

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance

Cutting and sampling of core samples was directed by Timberline representatives. Personnel from Timberline or the drilling contractors transported the samples to Timberline’s secure Eureka facility, from which the samples were picked up by personnel from ALS USA Inc. (ALS) for sample preparation in Elko, Nevada or Tucson, Arizona. Quality control was monitored by the insertion of numerous blind certified standard reference materials, field duplicates, and blanks into each sample shipment. Drill samples were assayed by ALS for gold by fire assay of a 30-gram charge with an AA or ICP-ES finish (ALS code Au-AA23). The overlimits for gold samples assaying above 10 g/t were determined by a 30-gram fire assay with gravimetric finish. Satisfactory results were achieved for all quality control samples related to the data reported herein. In addition, gold mineralized samples were submitted for multi-element analysis (33 elements) by four-acid digestion and ICP-ES determination (code ME-ICP61).

Steven Osterberg, Ph.D., P.G., Timberline’s Vice President Exploration, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release. Dr. Osterberg is not independent of the Company as he is an officer.

About Timberline Resources

Timberline Resources Corporation is focused on delivering high-grade Carlin-Type gold discoveries at its district-scale Eureka Project in Nevada. The Eureka Property includes the historic Lookout Mountain and Windfall mines in a total property position of approximately 24 square miles (62 square kilometers). The Lookout Mountain Resource was reported in compliance with Canadian NI 43-101 in an Updated Technical Report on the Lookout Mountain Project by Mine Development Associates, Effective March 1, 2013, filed on SEDAR April 12, 2013 (see cautionary language below).

The Company is also operator of the Paiute Joint Venture Project with Nevada Gold Mines in the Battle Mountain District. These properties lie on the prolific Battle Mountain-Eureka gold trend. Timberline also controls the Seven Troughs Project in northern Nevada, which is one of the state’s highest-grade former gold producers. Timberline controls over 43 square miles (111 square kilometers) of mineral rights in Nevada. Detailed maps and mineral resources estimates for the Eureka Project and NI 43-101 technical reports for its projects may be viewed at https://timberlineresources.co/.

Timberline is listed on the OTCQB where it trades under the symbol “TLRS” and on the TSX Venture Exchange where it trades under the symbol “TBR”.

On behalf of the Board of Directors,

“Patrick Highsmith”

President and CEO

Tel: 208-664-4859

Forward-looking Statements:

Statements contained herein that are not based on current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These statements include but are not limited to: statements regarding the Eureka Project resources, exploration targets, and discovery potential, as well as statements regarding future extraction operations. When used herein, the words “anticipate”, “believe”, “estimate”, “upcoming”, “plan”, “target”, “intend”, “growth”, and “expect” and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, risks related to exploration projects, risks related to mining activities, risks related to potential future transactions, risks related to the Company continuing as a going concern, risks related to the ability to finance any payments due, risks related to project development decisions, risks related to mineral resource estimates and other such factors, including risk factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Except as required by Federal Securities law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Mineral Resources:

Until mineral deposits are actually mined and processed, mineral resources must be considered as estimates only. Mineral resource estimates that are not classified as mineral reserves do not have demonstrated economic viability. The estimation of mineral resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the foregoing Cautionary Statements. The accuracy of any mineral resource estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. The quantity and grade of “inferred” mineral resource estimates are uncertain in nature and there has been insufficient exploration to define “inferred” mineral resource estimates as an “indicated” or “measured” mineral resource and it is uncertain if further exploration will result in upgrading “inferred” mineral resource estimates to an “indicated” or “measured” mineral resource category. It cannot be assumed that all or any part of a “inferred”, “indicated” or “measured” mineral resource estimate will ever be upgraded to a higher category including a mineral reserve.

The mineral resource estimates declared by the Company were estimated, categorized and reported using standards and definitions under applicable Canadian securities laws governing the public disclosure of scientific and technical information concerning mineral projects. Accordingly, information describing mineral resource estimates for the Company’s projects may not be comparable to similar information publicly reported in accordance with the applicable requirements of the United States Securities and Exchange Commission, and so there can be no assurance that any mineral resource estimate for the Company’s projects would be the same had the estimates been prepared per such requirements.